michigan use tax act

USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal property and certain services. The Use Tax Act imposes tax on tangible personal property that is used stored or consumed in Michigan at a rate of 6 of the purchase price unless.

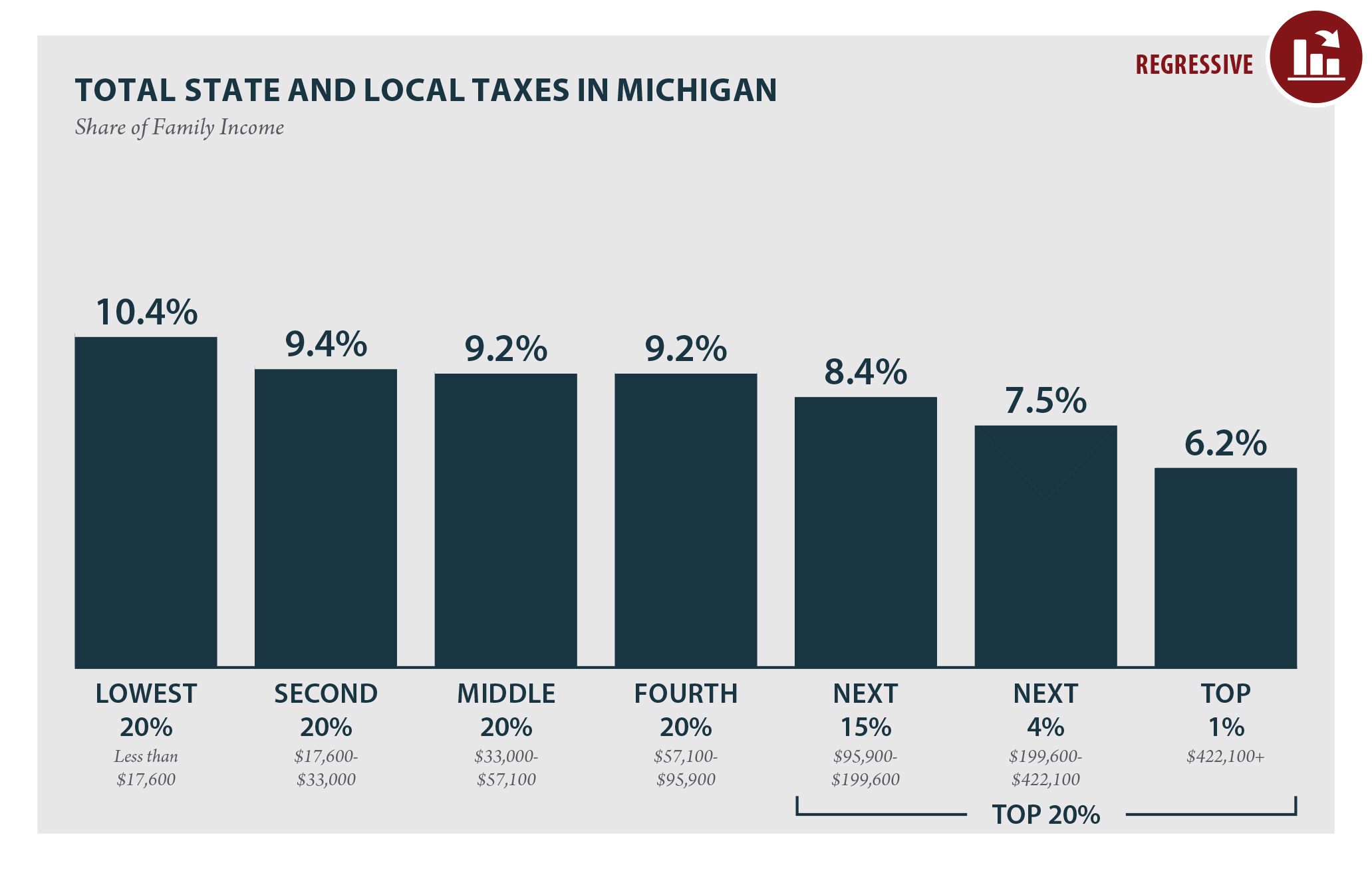

Michigan Who Pays 6th Edition Itep

This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department.

. Use is defined as the exercise of any right over tangible personal property incident to ownership of that property. The following publication of the Michigan Use Tax Act is current as of September 1 2009. 2015 Act 177 Eff.

Act 206 2111a Short title. Over 50 Million Tax Returns Filed. Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax.

The use tax was enacted to compliment the sales tax. McIntyre Multistate Taxation in the Digital Age Wayne State University Law School. Ad Receive you refund via direct deposit.

Michigans use tax rate is six percent. C Storage means a keeping or retention of property in this state for any purpose after the property loses its interstate character. To provide incident to the enforcement thereof for the issuance of licenses to engage in such occupations.

Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. Where the sales tax is primarily imposed on the seller of tangible personal property at retail. The Michigan Use Tax Act Sec.

History2004 Act 175 Eff. Helpful Resources Sales and Use Tax Information for Remote Sellers. Converting tangible personal property acquired for a use exempt from the tax levied under this act to a use not exempt from the tax levied under this act is a taxable use.

AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state for the privilege of engaging in certain business activities. This act shall be known and may be cited as The general property tax act. A taxpayer person required to file an Informational Report that fails or refuses to file the report within the time and in the manner specified under the statute is liable for a penalty of 1000 per day for each day for each separate failure or refusal up to but not exceeding a maximum penalty of 50000 for each separate violation.

Likewise the Use Tax Act was amended by 1989 PA 141 effective retroactively January 1 1989 to exempt portable grain bins and land tiles from the use tax. For prior tax laws see note to this section in Michigan Compiled Laws of 1970. Use tax on tangible personal property is similar to sales tax but applies to purchases when Michigan sales tax is not charged.

20591 Use tax act. Ad IRS-Approved E-File Provider. From Simple to Advanced Income Taxes.

TO the extent that the telephone communication service including cost of the service passed on the customer is intrastate-both originating and terminating in Michigan. 1 The tax levied under this act does not apply to the purchase of machinery and equipment for use or consumption in the rendition of any combination of services the use or consumption of which is taxable under section 3a1a or c or 3b except that this exemption is limited to the tangible personal property located on the premises of the subscriber and to central office. For transactions occurring on or after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan.

The use tax is. As used in this act. Ad Avalara Consumer Use Reconciles Transactions and Automates Your Use Tax Compliance.

M Use tax means the tax levied under the use tax act 1937 PA 94 MCL 20591 to 205111. 205175 Tax on motor fuel and alternative fuel used by interstate motor carrier. To appropriate the proceeds of that tax.

Use tax of 6 percent must be paid on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases by mail from out-of-state retailers. Michigan General Sales and Use Tax Acts. 1 As used in this act.

B Sale at retail means a transaction by which the ownership of tangible personal property is transferred for. Public Act 519 provided a sales tax exemption for commercial fishing activities. Any research into the law should include a.

The People of the State of Michigan enact. Telecommunications - Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

USE TAX ACT Public Act 94 of 1937 Effective October 29 1937 AS AMENDED Since the enactment of the Michigan Use Tax Act PA 94 of 1937 it has been amended numerous times. Michigan General Sales and Use Tax Acts. This act may be cited as the Use Tax Act.

TO the extent that the telephone communication service including cost of the service passed on the customer is intrastate-both originating and terminating in Michigan feescharges are taxable. Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications. Quickly Prepare and File Your 2021 Tax Return.

USE TAX Michigans 6 use tax is imposed on a purchaser for the act of storing using or consuming tangible personal property in Michigan. A Person means an individual firm partnership joint venture association social club fraternal. As of January 1 2004 Prof.

History1937 Act 94 Eff. To provide for the ascertainment assessment and collection thereof. 31 MCL 20593 provides in part that There is levied upon and there shall be collected from every person in this state a specific tax including both the local community stabilization share and the state share.

General property tax act.

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

Pin On Written Communications Test For Police Exam

Sales Tax On Cars And Vehicles In Michigan

25 Things You Learn While Living In Michigan State Of Michigan Michigan Historical Newspaper

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Pin By Paradoxical On Tumblr Darling Tumblr Funny Funny Tumblr Posts Funny Quotes

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims

Michigan Intestate Succession Flowchart Estate Planning Attorney Estate Planning State Of Michigan

Michigan Sales Tax Small Business Guide Truic

Tumblr Tuesday 9 8 Tumblr Funny Funny Tumblr Posts Funny Quotes

Michigan Motor Vehicle Power Of Attorney Form Tr 128 Power Of Attorney Form Power Of Attorney Power

State Of Michigan Taxes H R Block

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Customer Is Always Right Tumblr Funny Funny Tumblr Posts Funny Quotes

Michigan Foreclosure Prevention Corps Recruitment Flyer 2015 Flyer How To Apply Prevention

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Online Taxes

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc